Some Of Summitpath Llp

Table of Contents8 Simple Techniques For Summitpath LlpThe Single Strategy To Use For Summitpath LlpThe Definitive Guide for Summitpath LlpThings about Summitpath Llp

Most lately, introduced the CAS 2.0 Practice Growth Mentoring Program. https://www.behance.net/josehalley. The multi-step coaching program consists of: Pre-coaching placement Interactive group sessions Roundtable discussions Embellished training Action-oriented mini plans Companies seeking to expand right into consultatory services can also transform to Thomson Reuters Method Onward. This market-proven method supplies material, devices, and guidance for companies interested in advisory servicesWhile the adjustments have actually opened a number of growth opportunities, they have likewise resulted in difficulties and problems that today's companies require to have on their radars., companies have to have the capacity to quickly and efficiently conduct tax research study and enhance tax obligation reporting efficiencies.

Additionally, the new disclosures may bring about a rise in non-GAAP procedures, historically an issue that is highly looked at by the SEC." Accounting professionals have a whole lot on their plate from regulatory adjustments, to reimagined service designs, to an increase in customer expectations. Maintaining rate with everything can be challenging, but it does not have to be.

The Facts About Summitpath Llp Uncovered

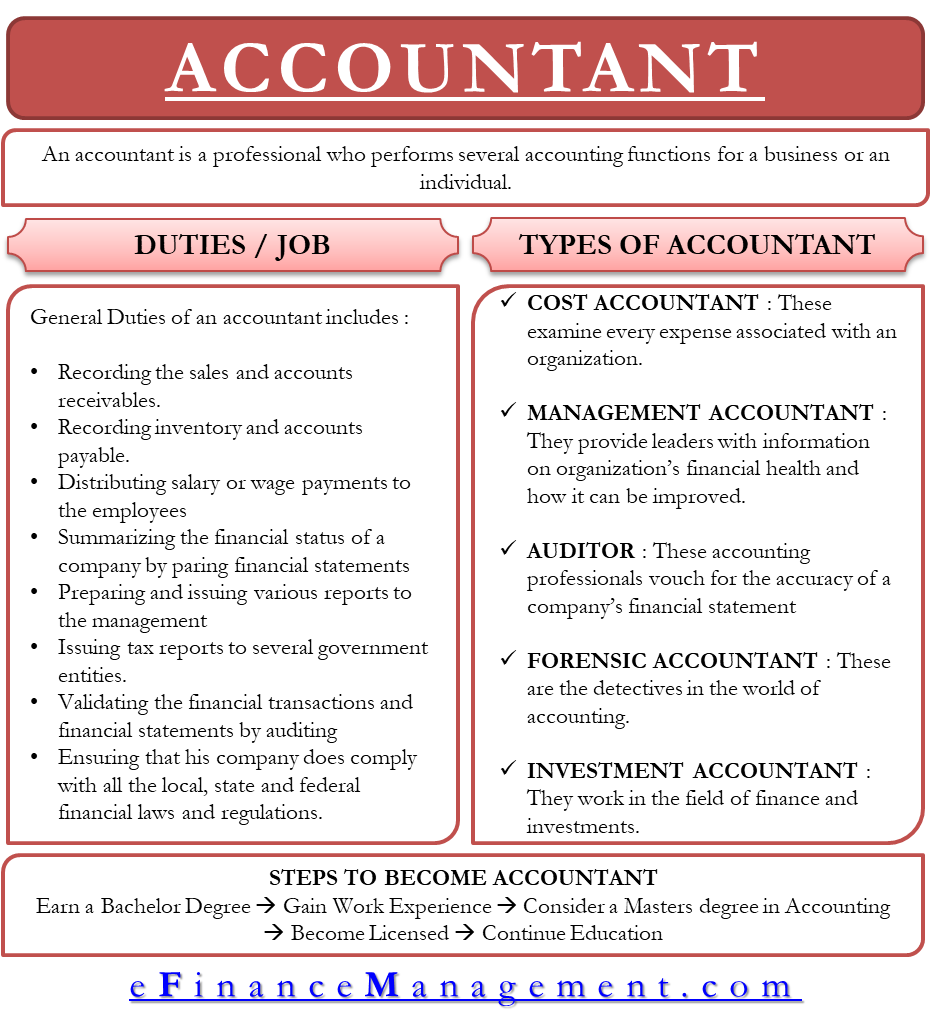

Listed below, we describe four certified public accountant specializeds: tax, administration accountancy, monetary coverage, and forensic accountancy. CPAs specializing in taxation aid their clients prepare and file tax obligation returns, lower their tax burden, and prevent making mistakes that can cause expensive penalties. All Certified public accountants require some understanding of tax regulation, however specializing in taxes suggests this will be the focus of your job.

Forensic accountants normally begin as general accounting professionals and relocate into forensic audit roles over time. Certified public accountants who specialize in forensic audit can often move up into administration audit.

No states require an academic degree in accounting. Nonetheless, an accountancy master's level can help pupils meet the certified public accountant education demand of 150 credit reports since the majority of bachelor's programs just require 120 credit scores. Bookkeeping coursework covers subjects like money - http://169.48.226.120/www.summitpath.ca, auditing, and taxation. Since October 2024, Payscale records that the ordinary yearly income for a certified public accountant is $79,080. outsourcing bookkeeping.

Accounting additionally makes useful sense to me; it's not simply theoretical. The Certified public accountant is an important credential to me, and I still get continuing education credit scores every year to maintain up with our state demands.

The Ultimate Guide To Summitpath Llp

As an independent consultant, I still utilize all the standard structure blocks of audit that I discovered in university, pursuing my CPA, and operating in public accountancy. One of the important things I truly like about audit is that there are several work available. I made a decision that I intended to begin my job in public accountancy in order to discover a lot in a brief period of time and be revealed to different types of clients and various areas of audit.

"There are some workplaces that do not desire to take into consideration a person for an accountancy function who is not a CPA." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A certified public accountant is an extremely important credential, and I wished to place myself well in the market for various work - CPA for small business. I made a decision in college as an accountancy major that I desired to try to get my certified public accountant as soon as I could

I've satisfied lots of wonderful accountants that don't have a CPA, however in my experience, having the credential really aids to advertise your competence and makes a distinction in your payment and career choices. There are some workplaces that do not wish to take into consideration somebody for a bookkeeping duty who is not a CPA.

The Summitpath Llp Diaries

I truly appreciated functioning on different kinds of jobs with different clients. In 2021, I made a decision to take the next step in my bookkeeping profession journey, and I am now an independent accounting consultant and business expert.

It remains to be a growth area for me. One vital quality in being a successful certified public accountant is genuinely caring about your clients and their organizations. I love collaborating with not-for-profit clients for that very reason I really feel like I'm actually adding to their objective by assisting them have good economic information on which to make clever company choices.